Moving into your first apartment is exciting, but it often comes with a hefty request: a security deposit. This pot of money, usually equivalent to one month’s rent (or two if you’re feeling particularly unlucky), is meant to protect landlords from any damage or missed rent. But as a young professional, first-time renter, couple, or family, you might wonder: what rights do I have? How can I ensure I get my hard-earned cash back? Fear not! Let’s break down the ins and outs of security deposits—a quintessential rite of passage for anyone jumping into the rental scene! Whether you’re haggling over the details, preparing for your walkthrough, or just trying to understand the legal jargon, we’ve got you covered. So grab a cup of coffee (or a glass of wine, we won’t judge), and let’s get into the nitty-gritty of security deposits!

Understanding Security Deposits: What’s in a Number?

A security deposit serves as a financial safeguard for both renters and landlords, acting as a safety net for potential property damage or unpaid rent. It represents a monetary buffer, ensuring that landlords can address any unforeseen issues when a tenant vacates. For many young renters, the idea of a security deposit might seem daunting, especially when budgeting for immediate necessities. However, understanding its purpose and calculation can demystify this crucial component of renting.

Typically, a security deposit is calculated as one to two months’ worth of rent. The specific amount often reflects the local rental market and the perceived risk to the landlord. For instance, properties in high-demand areas may require a higher deposit due to market pressures. It’s not about taking away from your pizza budget, but rather about safeguarding the property and ensuring responsible tenancy.

Security deposits primarily cover damages beyond normal wear and tear. They might also be used to settle unpaid rent or cleaning fees if the apartment is left in an unsatisfactory state. This deposit is not meant to cover ordinary maintenance, such as repainting walls due to minor scuffs or replacing worn-out carpets without significant damage.

Landlords ask for a security deposit to encourage tenants to care for their rented space as if it were their own. It also acts as a financial motivation for tenants to fulfill the lease agreement responsibly. In many jurisdictions, regulations exist to protect both parties, ensuring that security deposits are kept in separate accounts and returned promptly when the lease ends, provided there are no issues.

Some common myths suggest that the deposit is an additional revenue stream for landlords. In reality, landlords are legally bound to return the deposit, often with interest, assuming no lease violations. Another myth is the belief that deposits are non-negotiable. While there is often a standard, savvy renters may sometimes negotiate a lower deposit, especially if they have strong rental histories or references.

For those concerned about initial move-in costs, budgeting strategies such as meal prepping can ease the financial strain. For guidance on managing your finances effectively in a new apartment, explore this resource on apartment grocery budgeting.

Ultimately, understanding the practical reasons behind security deposits helps demystify this aspect of renting. They are essential, not as obstacles, but as tools to foster trust and accountability in the renter-landlord relationship.

Getting Your Security Deposit Back: The Art of the Walkthrough

The moment you decide to move out, your mind may drift toward planning your new apartment layout, but don’t forget the walkthrough. This step is pivotal in securing the return of your precious security deposit. Each scuff and mark could translate into dollars deducted. Let’s explore how to ace your final inspection and avoid unwelcome surprises.

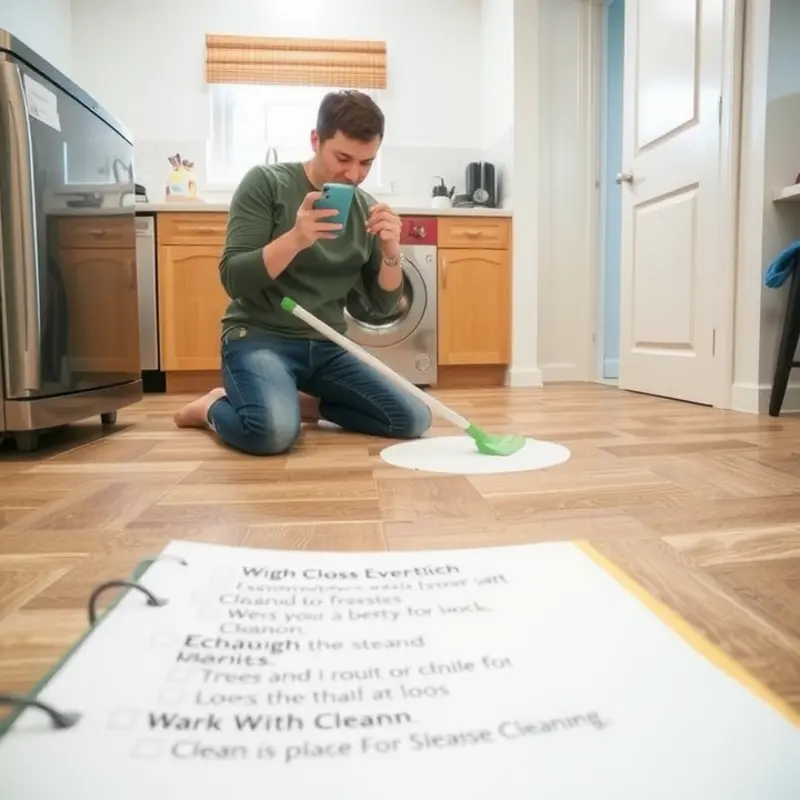

Before vacating, conduct a thorough pre-move-out assessment. Use your smartphone to document everything. Capture images and video, focusing on walls, floors, and any previously agreed-upon repairs. Remember, evidence is your ally in conversations about potential deductions.

Understanding the difference between normal wear and tear and damage is crucial. Normal wear and tear refers to minor imperfections that occur with use, like faded paint or mildly worn carpet. These are usually not deducted from a security deposit. On the other hand, damage might include things like large stains, holes in walls, or broken fixtures. Familiarize yourself with your state’s landlord-tenant laws to further elucidate what’s acceptable.

The inspection begins even before you move in. Keep photos from your initial walkthrough to demonstrate what was present pre-tenancy. This comparison is your go-to refutation for unfair claims of damage.

Communication with your landlord is key—be proactive. Alert them to any issues well before your lease ends. This gives you time to address problems and show good faith efforts on your part. If there are repairs needed, discuss who bears financial responsibility to avoid assumptions that can lead to deductions.

On inspection day, be present. Engage with the inspector and don’t hesitate to reference the documentation you’ve collected. Many deductions occur simply because tenants are not informed about the problems claimed. Your photos and records empower you to have these conversations confidently.

Common pitfalls often stem from overlooked elements, like cleaning. Ensure everything is spotless, as cleaning charges are a frequent reason for deductions. If landlords claim cleaning beyond normal expectations, ask for receipts for services rendered.

Pet owners should pay extra attention. Ensure all pet-related damage, such as scratches or carpet wear, is addressed. For tips on an apartment more accommodating to your furry friends, learn here. Small fixes like spackling nail holes or tightening loose doorknobs can also make a huge difference.

On the rare occasion where disputes arise post-walkthrough, escalate towards reasoned negotiation. You may enlist state tenant services if needed, but remember your ultimate goal: collaboration. A good faith discussion can often lead to resolution without the escalation.

Mastering the walkthrough is less about confrontation and more about preparation and communication. With these steps, you’re well on your way to reclaiming your deposit effectively, avoiding pitfalls, and minimizing stress during your move.

Final words

Understanding the ins and outs of security deposits is crucial for any young renter ready to tackle their first apartment. By navigating the initial requirements and being prepared during the moving-out process, you can maximize your chances of receiving that sweet security deposit back in your pocket. Whether you’re preventing incidental mishaps or questioning your landlord, remember that knowledge is power—and the best weapon you can wield as a renter. So go on, embrace the journey of apartment renting with confidence, and savor the freedom of your own space (with a little extra cash when you move out)!