Whether you’re a young professional moving into your first apartment or a couple looking to rent your dream home, life is full of exciting new adventures. But with these adventures comes a few necessary precautions, and that’s where renter’s insurance struts in like a superhero, cape and all. Did you know that your landlord’s insurance doesn’t cover your personal belongings? If your prized vintage vinyl collection or brand-new gaming console was suddenly borrowed by a sticky-fingered thief or a rogue ceiling leak, you’d be left high and dry. Renter’s insurance is not just an added expense—it’s an investment in peace of mind, covering your stuff from unexpected mishaps. In this light-hearted yet informative guide, we’ll unravel the basics of renter’s insurance, why it’s important, and how to choose the right plan without breaking the bank. So, grab your favorite snack, sit back, and let’s dive into the world of protection!

The What and Why of Renter’s Insurance

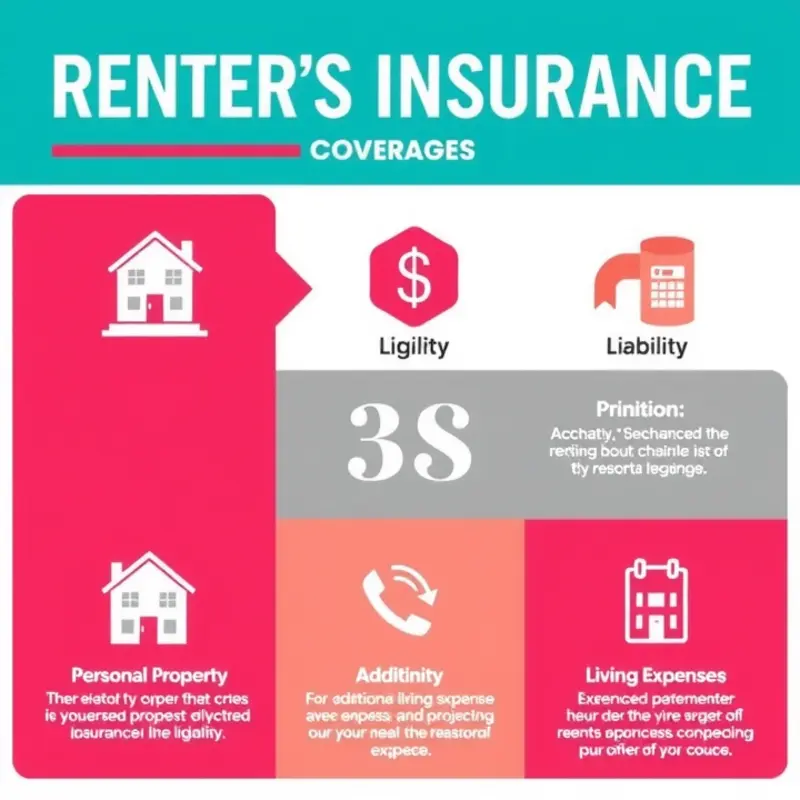

Renter’s insurance is a pivotal aspect of the renting process that often goes overlooked, especially among first-time renters and young families. At its core, renter’s insurance is designed to protect your personal space and possessions from unexpected events, and it typically covers three primary components: personal property coverage, liability protection, and additional living expenses.

Personal Property Coverage is perhaps the most straightforward aspect of renter’s insurance. This part of the policy covers the replacement cost of your belongings in case of damage or loss due to incidents such as fire, theft, or vandalism. For example, if a fire were to destroy your apartment, the cost of replacing items like furniture, electronics, and clothing could be overwhelming without insurance. Importantly, personal property coverage is not confined solely to items within your apartment; it often extends to your possessions outside the home as well, providing coverage even if, say, your laptop is stolen while you’re at a coffee shop.

Another crucial facet of renter’s insurance is Liability Protection. This component shields you from financial responsibility should someone be injured in your rented space or if you accidentally cause damage to someone else’s property. Imagine you’re hosting a small dinner party, and a guest trips over a misplaced rug, leading to injury. Without liability coverage, you could be personally liable for medical costs. Similarly, if an accidental bathtub overflow damages a neighbor’s apartment, liability coverage can protect you from the potentially high repair costs.

Lastly, Additional Living Expenses (ALE) coverage is an essential feature that many renters may not consider until it’s needed. This coverage comes into play if a covered event makes your rental unit uninhabitable. For instance, if a fire renders your apartment unlivable, ALE covers the increased cost of living expenses, such as hotel bills and meals, until you’re able to return home.

Some might wonder whether renter’s insurance is truly necessary. After all, can’t these situations be avoided through caution and care? While proactive measures can reduce risks, they cannot eliminate the unforeseen. Fires, theft, and other incidents can and do happen even in seemingly safe environments. Moreover, landlord insurance typically covers the structure of the building but does not extend to tenants’ belongings or liability.

For those embarking on the renting journey, understanding the specifics of renter’s insurance is invaluable. It offers peace of mind, knowing that your belongings and potential liabilities are safeguarded. Moreover, it is often a small price to pay for significant protection.

As you evaluate your renting options, take a moment to consider all aspects of moving into a new space. From choosing an apartment to understanding your lease terms, every decision counts. For insights into the importance of lease comprehension, consider visiting Understanding Lease Terms. Embracing renter’s insurance as part of this process ensures that you are fully equipped to tackle the challenges and uncertainties of renting with confidence.

Choosing the Right Policy (Without Losing Your Mind)

Choosing renter’s insurance that balances coverage and cost can be daunting, but fear not. With the right approach and a bit of research, you can find a policy that suits your needs without overwhelming your budget.

Start by assessment. Determine what you own and how much it’s worth. Inventory your belongings, including electronics, furniture, and clothing. It’s surprising how quickly these items add up. Knowing their total replacement value helps tailor your coverage. An excess or insufficient estimate can lead to overpaying or under-protecting your belongings.

Once you have a clear picture of your possessions, it’s time to compare quotes. Use online tools for a hassle-free way to see what’s on offer. Look beyond the price tag; delve into what each policy covers. Some may offer attractive premiums but skimp on crucial protections. On the other hand, higher-cost options might cover scenarios that don’t apply to you.

Understanding deductibles is another critical component. A deductible is what you’ll pay out of pocket before your insurance kicks in. Policies with lower deductibles generally have higher premiums, and vice versa. Consider your financial situation and ability to pay a higher deductible should a claim arise.

When examining policy details, pay special attention to replacement cost vs. actual cash value. Replacement cost policies cover the expense of replacing your items with new ones. Actual cash value accounts for depreciation, potentially leaving you out of pocket if you need to replace older items. Though replacement cost policies can be pricier, they may prove invaluable if you need to make a substantial claim.

Consider any additional features a policy might offer. Some insurers provide coverage for alternative housing arrangements if your rental becomes uninhabitable, liability protection, or coverage for theft from vehicles. Evaluate if these extra features align with your lifestyle and whether they justify the added expense.

It may also be wise to review information on the renters insurance claims process, ensuring you understand how to act if the need arises to file a claim. Knowing this in advance can save time and stress during an already challenging situation.

Finally, never skip the fine print. Read through your policy document thoroughly, ensuring clarity on limits, exclusions, and any specific conditions. Insurers rely heavily on this documentation, and it’s not unheard of for vital details to be buried within text-heavy sections.

By following these steps, you can secure renter’s insurance that provides peace of mind without breaking the bank. Equip yourself with knowledge and be prepared; your choice of coverage is more than just a financial decision, it’s a crucial part of protecting your home and possessions.

Final words

In the grand adventure of renting, having renter’s insurance can feel like that trusty umbrella you keep handy for unpredictable weather: it’s there to protect you when unforeseen events rain down. Whether you’re safeguarding your must-have belongings, avoiding liability nightmares, or ensuring you’re not left homeless due to a covered incident, renter’s insurance has your back. As you step into your next renting experience, give yourself the gift of security by exploring this essential coverage. After all, your home is your sanctuary—make sure it’s protected like the gem it is!