Navigating the rental market can be challenging, especially for young professionals, first-time renters, students, couples, and families. Understanding how to budget for rent is essential in making informed decisions about where to live. With various expenses linked to renting an apartment—from monthly rent payments to utilities—you may feel overwhelmed. However, utilizing a structured apartment rent budgeting template can simplify the process and provide financial clarity. These templates can guide you in assessing your overall financial situation, helping you determine what you can afford while offering insights into the costs associated with different properties. No matter your stage in life, be it fresh out of college or looking for a family home, having a breakdown of your expenses will ease the anxieties of renting. Let’s dive into effective budgeting strategies tailored to your needs, ensuring you find a comfortable space that aligns with your financial realities.

Understanding Core Housing Costs

When renting an apartment, understanding core housing costs is essential to create a realistic budget. A clear grasp of these expenses can ensure financial stability and help avoid unexpected surprises. Here, we delve into the fundamental costs you will encounter.

The first and most significant expense is the rent itself. Rent payments are typically the largest portion of your housing budget. It’s crucial to ensure that this amount fits comfortably within your overall budget—generally, it should not exceed 30% of your gross income. This limit helps maintain a balanced financial outlook while leaving room for other obligations.

Utilities form the next major category, encompassing costs for electricity, water, heating, and sometimes even garbage collection. Depending on your lease agreement and location, you might need to pay these separately or as part of your rent. Research average utility costs in your area to budget accurately. Check whether there might be seasonal variations, particularly with heating or cooling costs.

Renters insurance is another critical consideration, offering protection for your belongings and liability coverage in case of accidents. While often overlooked, it’s a minor monthly expense that can save substantial amounts in unexpected situations. Typically costing between $15 and $30 per month, it’s a small price for considerable peace of mind. For a deeper understanding of liabilities as a renter, explore understanding renter liabilities.

Miscellaneous fees can also impact your budget. These may include application fees, deposits, or fees for amenities such as gym access or parking. Additionally, factor in potential costs for service maintenance, like repairing clogged plumbing or broken windows not covered by the landlord. Understanding the scope of these miscellaneous expenses can prevent unforeseen financial strain.

Calculating these costs involves more than just adding numbers. Begin by listing all potential expenses in a dedicated budgeting tool or spreadsheet. Allocate appropriate amounts to each category based on research and personal constraints. Regularly reviewing and adjusting this budget can help in accommodating changes in any of these areas. Such visualization fosters a better understanding of your financial commitments and readiness to address them.

By comprehensively understanding and calculating these core housing costs, you arm yourself with the knowledge to make informed, confident decisions in your rental journey. This preparation aids not just in choosing the right apartment but also in maintaining a stable and sustainable financial ecosystem throughout your rental period.

Creating Your Apartment Rent Budget Template

Creating a personalized rent budgeting template involves careful planning. Start with outlining your monthly income sources. Whether you earn a salary, freelance, or have multiple income streams, it’s important to note each source clearly.

Once your income is listed, focus on the key area: fixed expenses. This includes your monthly rent, utility bills, internet, and any insurance premiums. Fixed expenses are predictable and usually stable, making them easier to budget for.

Next, it’s time to manage discretionary spending. Here, you consider items like groceries, dining out, streaming subscriptions, and entertainment. Be realistic and refer to past spending habits to set reasonable limits.

Don’t overlook occasional expenses. Lease deposits, maintenance costs, or moving fees can sneak up if not planned. Allocate a part of your budget to these anticipated but irregular costs. Keep in mind some maintenance tasks might be your responsibility; learn more about renter’s liabilities to prepare for those unforeseen expenses.

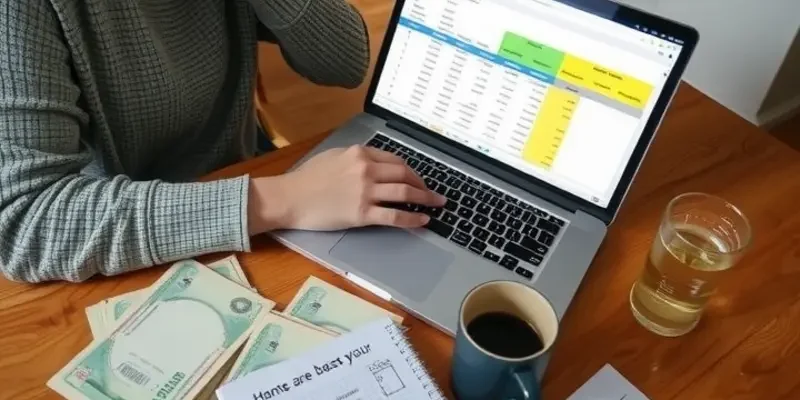

Moving onto template creation, digital tools offer convenience and accessibility. Start with a spreadsheet software. Create a column for each category: income, fixed expenses, discretionary spending, and occasional costs. Sum each category separately, then calculate your total expenses against total income.

Format your spreadsheet to distinguish each section. Use bold headings for clarity and color coding to differentiate categories. This visual structure aids in quick updates and easy understanding.

For those who prefer a traditional approach, a paper template works well too. A notebook or a printed template can serve this purpose effectively. Ensure you have columns for each category and track monthly, adding receipts if necessary to avoid overspending.

Review and adjust your budget monthly. Check if actual spending deviates from planned figures and tweak categories accordingly. Tracking your budget frequently helps you stay informed and make smarter financial choices.

Remember, your budgeting template is a living document. Its purpose is to assist, not restrict. By regularly updating and reviewing your budget, you maintain financial stability while enjoying your new living space.

Final words

Having a comprehensive apartment rent budgeting template is vital for anyone preparing to enter the rental market. Whether you are a young professional, a first-time renter, or a family, clearly understanding your housing costs will not only reduce stress but also empower you to make financially sound choices. Remember, budgeting is a continuous process—regularly revisit and adjust your template as your financial situation changes. With the right approach, you can confidently navigate the rental market and find a comfortable home that aligns with your budget.