Renting your first apartment can be both exciting and overwhelming, especially with the myriad of expenses involved. Among these, utilities often catch first-time renters off-guard due to their unpredictable nature. This guide aims to demystify apartment utility budgeting for young professionals, students, couples, and families. Understanding how to effectively budget for utilities not only helps in achieving financial clarity but also allows you to make informed decisions about your living situation. Whether you are looking at electric, water, gas, or internet bills, knowing what to expect can significantly ease your financial planning. By breaking down the various types of utilities, their average costs, and tips for better management, this guide provides the essential tools and knowledge you need to navigate your new living expenses confidently. Get ready to take control of your finances and create a comfortable living environment without the stress.

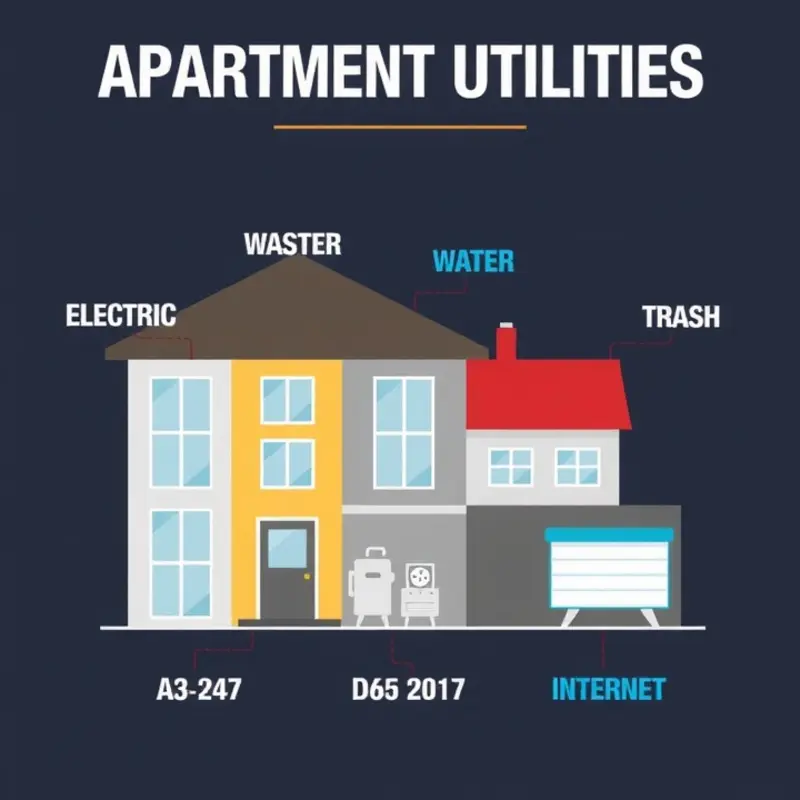

Understanding Apartment Utilities

As a renter, understanding apartment utilities is crucial for managing your monthly budget effectively. Most leases require tenants to cover some or all utility costs on top of rent. Let’s explore what these utilities are and how you can estimate their costs.

Electricity: Electricity powers lights, appliances, and heating or cooling systems. On average, renters can expect to pay between $50 and $150 per month, depending heavily on usage and the efficiency of your appliances. To estimate your cost, check the efficiency ratings of your appliances and consider seasonal use for items like air conditioners.

Water: Water usage covers your needs for cooking, cleaning, and bathing. Most tenants pay around $30 to $50 monthly, though high personal usage or landscaping can affect this. Ask your landlord or previous tenants about typical costs in your building.

Gas: Gas powers stoves and sometimes heating systems. Typically, the monthly expense ranges from $10 to $60. Your cost will vary significantly if you have a gas heater, peaking in winter months. Tracking your consumption during colder months helps you plan for these spikes.

Trash: Trash collection costs vary but are often included in rent. If not, it might be about $10 to $25 monthly. Verify how your building handles waste disposal, as fees may be tied to city or private collection services.

Internet: An essential utility for most households, internet services typically cost between $40 and $80 per month. Your needs may influence the plan you choose; for instance, high-speed options for remote work or gaming naturally cost more. Consider bundling services for potential savings.

Several factors influence utility costs: the apartment’s size, appliance age, your usage habits, and local climate conditions. Monitoring your usage can reveal patterns to optimize your consumption. It’s wise to start by estimating on the higher end and adjust after a couple of billing cycles. Calculating a realistic utilities budget provides insights before signing a lease and allows informed discussions with potential landlords. Understanding if costs are included in your rent or are your responsibility helps avoid surprises.

Transitioning into budget management extends beyond utilities. Check out our tips on financial planning for renters that can further assist in taking charge of your overall living costs.

Smart Budgeting Strategies for Utilities

Managing your utilities budget starts with setting a realistic spending plan. First, review your consumption habits. Analyze previous bills to understand your usage trends. This data forms the base of your budget. Once you have this estimate, allow a buffer for seasonal changes and unexpected costs.

Analyze and Adjust Usage Habits

Look into your daily routines to find cost savings. Small changes can make a big difference. For example, turning off lights when leaving a room or reducing shower time can lower electricity and water bills. Consider utilizing energy-efficient bulbs and low-flow showerheads. These investments may seem small, but they pay off over time.

Monitor and Engage with Your Bills

Bills are not just documents to pay; they are tools to guide your financial management. Set aside time each month to thoroughly review them. Look for patterns or irregularities. If you spot anomalies, contact your utility provider to resolve any potential errors. For tips on resolving such issues, check out these rental billing error solutions. The more familiar you are with your bills, the more empowered you’ll be to control your expenses.

Embrace Energy-Saving Tips

Take advantage of technology that helps manage consumption. Programmable thermostats can adjust heating and cooling to match your schedule. During warmer months, close blinds or curtains to reduce cooling costs. In colder seasons, let sunlight naturally warm your apartment by opening them. Additionally, regular maintenance of appliances ensures they run efficiently.

Explore Bundled Packages

Investigate bundled services for potential savings. Some providers offer discounts when you combine internet, cable, and utilities. Before committing, compare these deals with individual service costs to see if they align with your budget.

Negotiate Utility Costs

It’s possible to negotiate some utility costs, especially if you’re a long-term tenant. Speak to your landlord to discuss reducing fees when leases are up for renewal. Emphasize your prompt payment history and a willingness to renew for another term. Similarly, negotiating with providers for better rates or plans tailored to your usage can be beneficial.

By implementing these strategies, you’ll gain better control over your utilities without compromising on comfort. Through smart budgeting, you can transform these costs from burdensome bills into manageable parts of your overall financial plan.

Final words

Budgeting for apartment utilities can seem daunting at first, but with the right strategies and a clear understanding of your expenses, it becomes far more manageable. Taking the time to learn about the types of utilities you will encounter and developing sensible budgeting techniques will empower you to control your finances effectively. As you navigate your rent and other living costs, remember that small changes in your energy usage can lead to significant savings. Embrace this journey as an opportunity not just to secure your comfort, but also to simplify your financial life. You’ve got this!