Renting a home can be overwhelming, especially for young professionals, first-time renters, students, couples, and families. One crucial element that often gets overlooked in the chaos of moving is the rent payment receipt. This little slip of paper or digital confirmation doesn’t just serve as proof of payment; it’s a vital tool for financial clarity, aiding in budget tracking and lease management. Having an organized approach to your rent receipts can streamline your financial process and prepare you for any disputes with landlords or property managers. Whether it’s your first apartment or a family home, understanding the significance of these receipts will empower you in your rental journey. By knowing what to look for and how to maintain records, you’ll gain peace of mind and confidence in your living situation. In the following chapters, we’ll break down what rent payment receipts are, why they matter, and how to manage them efficiently.

Understanding Rent Payment Receipts: The Basics

Rent payment receipts are documents that confirm the successful transfer of funds from a tenant to their landlord. These receipts serve as proof of payment and are crucial for both parties in ensuring transparency and maintaining financial records. There are mainly two types of rent payment receipts: paper and digital.

Paper receipts are the traditional form of documentation. They often bear the signature of the receiver and provide details such as the date of payment, amount, and method of payment. Tenants should store these documents in a safe place, such as a dedicated folder, to prevent them from being misplaced or damaged.

Digital receipts have gained popularity due to their convenience and accessibility. They are typically sent via email or made available through an online portal associated with the landlord or property management system. Digital receipts can be easily stored in cloud storage services, ensuring they are backed up and easy to retrieve when needed.

The importance of rent payment receipts cannot be overstated. For tenants, these receipts serve as evidence of timely payments, which can be crucial during lease negotiations, especially if disputes arise regarding rent arrears. They also contribute to maintaining a clear financial record, which can assist in budgeting and financial planning. In the event of a disagreement with a landlord over payments, having a comprehensive record of these receipts can support the tenant’s position.

Moreover, rent payment receipts are invaluable when applying for future rentals or when engaging in financial discussions, such as those involving loans or credit applications. Landlords or financial institutions may request a history of rent payments to assess financial responsibility.

For landlords and property managers, issuing rent payment receipts can foster trust and transparency with tenants. It also aids in keeping accurate financial records, ensuring that incoming payments are tracked and discrepancies are minimized. This systematic approach to payment documentation aligns with best practices in property management.

Consider the broader context concerning tenant rights and repairs, where rent payment histories can impact discussions about the maintenance of living conditions. For more information on your rights as a tenant, you can explore tenant rights and repair responsibilities.

Rent payment receipts, whether paper or digital, form an integral part of the rental process. Their role in fostering understanding and clarity in financial transactions underscores their significance. As tenants, the responsibility to obtain, organize, and preserve these documents is vital to avoid potential disputes and to maintain a sound financial standing.

Keeping Organized: Best Practices for Managing Your Receipts

Managing your rent payment receipts efficiently can greatly enhance your financial clarity. Few things are as frustrating as realizing that a crucial document has disappeared when you need it most. Here are some impactful strategies to ensure your receipts are always within reach.

Digital Storage Solutions

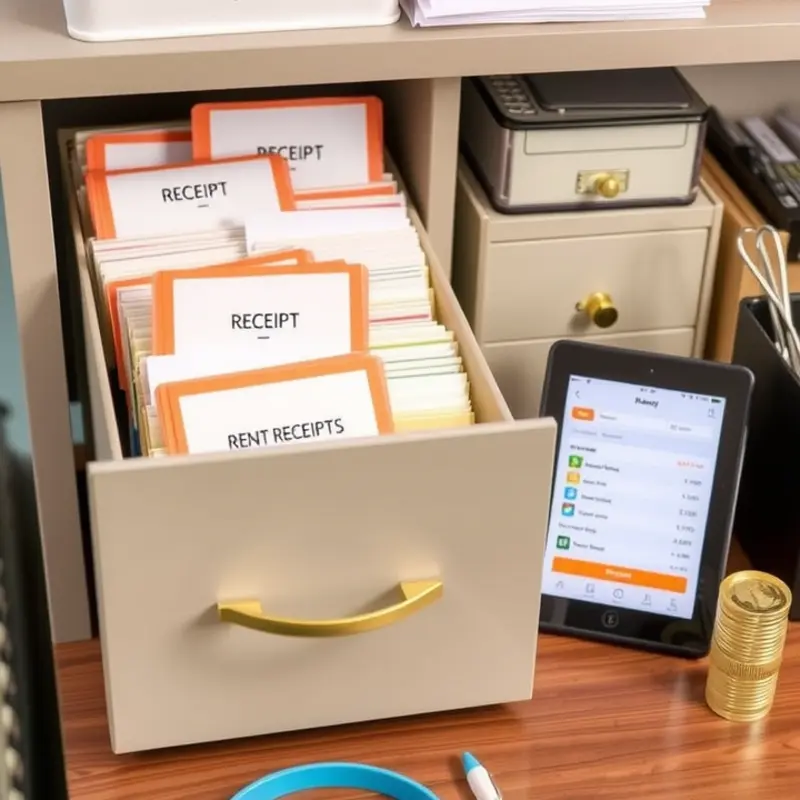

Electronic records are often safer and more accessible than physical copies. Scanning your rent payment receipts and saving them digitally should be an integral aspect of your receipt management strategy. Numerous apps and tools allow you to scan receipts using your smartphone camera, converting them into easily storable PDF or image files. Once digitized, categorize these files into folders named by month or payment period to streamline retrieval.

Cloud storage services are another excellent option. They can provide access from any device, offering seamless access during important lease negotiations or disputes. Always remember to label files clearly with the date and the payment amount for quick identification.

Physical Receipt Management

If you prefer retaining physical receipts, a well-organized filing system is essential. An accordion folder with labeled sections sorted by month can keep your documents in order. Store this folder in a secure, easily accessible location to prevent misplacement or damage. Adding color-coded tabs or post-it notes for particularly significant payments can further optimize your organization.

Tracking Payment History

Creating a central ledger can also enhance your receipt management practices. Whether done digitally or by hand, documenting every payment, along with its date and amount, offers a clear picture of your financial commitments. This ledger can double as a quick reference guide when questions about payment arise.

You might also link your rent payments to a financial tracking app. These apps often allow you to categorize expenses and even set reminders for upcoming payments. Integrating your receipt management with your broader financial monitoring keeps everything in one place, minimizing oversight and errors.

Regular Audits

Conducting periodic audits of your stored receipts ensures everything is up to date. A monthly check-in can catch missing documents early, preventing potential disputes with your landlord. Plus, maintaining a habit of regular audits can alert you to unauthorized charges or accounting errors.

Secure Backups

In case of device failure or accidental loss, having backups of your digital receipts is vital. Store copies on an external hard drive or another cloud service as a secondary layer of security. This protective step ensures your records remain intact even if your primary storage solution fails.

For more comprehensive tips on managing your household finances, you can explore related topics such as renters insurance claim tips, which includes guidance on protecting yourself from unforeseen circumstances.

By employing these strategies, managing your rent payment receipts can transform from a tedious task into an organized and efficient process. This fosters not just peace of mind but also equips you to handle lease-related discussions with confidence and ease.

Final words

Rent payment receipts are more than just a record of your transactions; they are a crucial component of managing your finances and ensuring a smooth landlord-tenant relationship. The peace of mind they provide is invaluable, especially when navigating the complexities of leases and budgeting. By maintaining an organized system for storing these receipts, you can prevent financial surprises and prepare for any potential disputes with your landlord. Remember, keeping track of your rental payments isn’t just about being responsible—it’s about taking control of your financial journey. So take a moment to establish a system that works for you. Your future self will thank you!