Navigating the world of renting can feel overwhelming, especially when it comes to understanding your credit score. For young professionals, first-time renters, students, couples, and families, it’s essential to recognize how rent payments can influence your financial health. While many may think only of loans and credit cards regarding credit scores, payment history on rent can also play a crucial role. Being informed about these dynamics helps you make better decisions in your financial journey. Knowing how on-time rent payments can bolster your credit can empower you to negotiate better lease terms and build a stable financial future. Understanding this relationship allows you to enjoy the benefits of responsible renting while securing your credit standing.

Decoding Credit Scores: How Rent Payments Fit In

Credit scores often feel like a mysterious three-digit number that dictates your financial opportunities. Understanding them is crucial for young professionals, first-time renters, and families alike. A credit score is a numerical representation of a person’s creditworthiness, influenced by various financial behaviors.

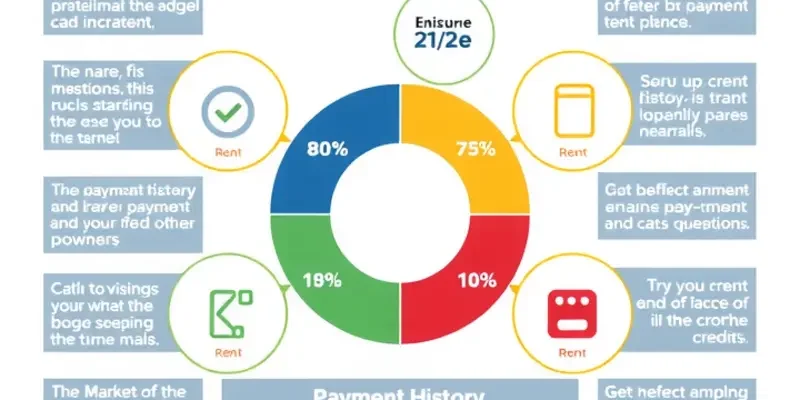

Lenders and landlords frequently rely on credit scores to evaluate potential clients. These scores range from 300 to 850 in most cases, with a higher score indicating better creditworthiness. Several factors contribute to this number, including payment history, amounts owed, length of credit history, new credit, and types of credit in use. Among these, payment history typically carries the most weight—a crucial insight for anyone aiming to improve their score.

Traditionally, rent payments were not included in credit reports, barring renters from reaping the benefits of timely rent payments. This oversight removed a major financial responsibility from the credit score equation, one which could positively influence a renter’s credit profile. However, the landscape is changing. Some newer credit scoring models now recognize rent payment history as an indicator of creditworthiness, allowing renters to build and improve their credit scores through consistent rent payment habits.

How Rent Payments Influence New Credit Models

Following trends in the housing market, credit models acknowledging rent payments are gaining traction. A notable factor is that consistent, on-time rent payments serve as a reliable indicator of an individual’s likelihood to meet other financial obligations. Renters who consistently pay on time and manage their financial obligations well see their diligence reflected in their credit scores when using these updated models.

Reporting rent payments can be a strategic tool, particularly for those who have limited credit history or are looking to boost their scores. However, not every credit scoring model considers rent payments yet. Familiarizing yourself with which models do can offer renters an edge. It’s also vital to ensure your rent payments get reported—something you might need to discuss with your landlord or property management company.

This progress offers renters newfound opportunities to leverage their payment history to open doors to better financial products. Renters should take proactive steps to ensure their consistent payments are recognized. Engaging with modern financial services that support this reporting can be a game changer for many.

For renters looking to better understand their rights when it comes to selecting a place and managing payments, reading about tenant rights and security deposits might provide additional insights.

Navigating the waters of credit scores can seem daunting, especially for those unfamiliar with the intricacies. However, as the financial landscape evolves, renters are afforded more opportunities to improve their financial standing through what was once considered a simple monthly obligation. Ensuring accurate and timely rent payments can now be an essential part of personal financial growth.

Maximizing Your Credit Score Through Rent Payments

Rent payments have the potential to positively impact your credit score, provided you know how to leverage them effectively. Using online platforms that report your rent payments to credit bureaus is one of the simplest ways to ensure your rent boosts your credit profile. These platforms are designed to track and report your rent payments just as lenders report your loan payments, allowing timely rent payments to bolster your credit history.

Establishing a good rental history not only aids in surfacing a responsible credit record, but also provides benefits beyond credit reporting. A solid rental history can lead to easier lease renewals and can serve as a credible reference for future housing opportunities.

To maximize these benefits, start by selecting an online payment system that includes credit reporting. Once set up, make sure to pay your rent through this system consistently. You may need to verify with your landlord whether they support or participate in such a payment system, which underscores the importance of good communication. Discuss your intentions with your landlord or property manager to report your rent payments for credit purposes. Many landlords might be open to this, especially when they understand it encourages tenants to pay promptly.

Consistency in rent payments cannot be overstressed. Always ensure that your payments are made on or before the due date. Late payments can negate any positive effects on your credit score and potentially damage your credit record.

For young professionals and first-time renters, understanding the rental landscape is crucial. Reviewing your rental agreement and understanding your rights as a tenant can provide leverage when discussing with landlords. Being aware of tenant rights, such as the ones detailed here, can improve your position during such discussions.

Finally, good habits foster strong credit profiles. Keep track of rental documents, payment confirmations, and any communication with your landlord. This information can be indispensable if discrepancies arise. Carefully maintaining these records and ensuring open communication channels with your landlord will help you safeguard your credit interests while enhancing your rental experience. By taking these proactive steps, your rent payments will serve as a powerful tool in building a robust and favorable credit profile.

Final words

Understanding the impact of rent payments on your credit score is pivotal for anyone looking to build a solid financial foundation. By ensuring that your rental history is positive and monitored, you can leverage this information to enhance your credit scores, making it easier to secure loans, mortgages, and other credit in the future. Embracing this knowledge allows you to manage your finances better and sets a course for achieving your long-term financial goals. Remember, every on-time payment can bring you one step closer to financial stability and success.