Navigating the complex world of apartment rentals can be daunting, particularly for first-time renters or young professionals. Understanding your financial obligations is crucial to fostering a healthy landlord-tenant relationship and ensuring a smooth rental experience. One key tool in keeping track of your payments and lease details is the apartment rent ledger. This straightforward yet vital document can provide insight into your rental history and details that may affect your future financial planning. Whether you’re a student living on a tight budget, a couple pooling resources, or a family managing multiple expenses, understanding your rent ledger can empower you as a tenant. In the following chapters, we will break down what a rent ledger is, how to interpret its sections, and tips to ensure you remain organized and informed throughout your renting journey.

What is a Rent Ledger and Why Does It Matter?

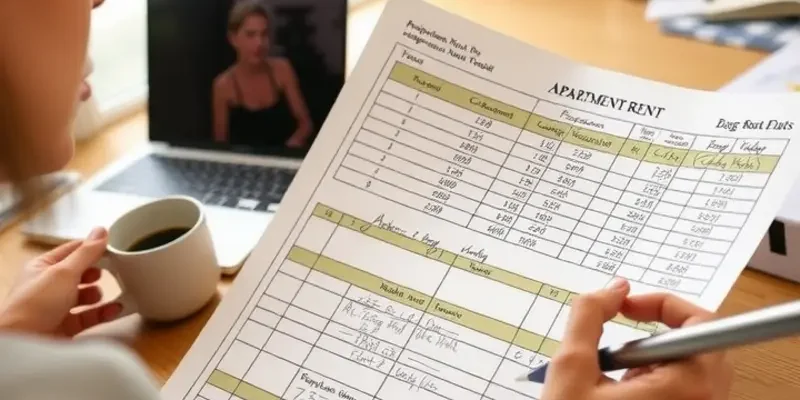

A rent ledger serves as a financial roadmap, helping tenants navigate through the complexities of rental payments and lease agreements smoothly. It is essentially a detailed record that lists every rental transaction, including due dates, amounts paid, and any outstanding balances. Keeping an accurate rent ledger is crucial because it provides both landlords and tenants with a clear financial overview of their rental arrangements.

For many renters, especially those new to renting, understanding and maintaining a rent ledger might seem daunting at first. However, its importance cannot be overstated. A rent ledger ensures transparency between you and your landlord, preventing misunderstandings regarding any financial obligations. This level of clarity is particularly beneficial because it keeps a documented history of all monies exchanged, which can be vital if disputes ever arise.

Consider students, for example. Often balancing part-time jobs with studies, they benefit greatly from maintaining a rent ledger. It helps them keep track of payments made from often limited and irregular incomes and provides a sense of security, particularly if they are living away from home for the first time. Having this clear record is not only reassuring but also necessary for budgeting purposes.

Similarly, young professionals, who may be newer to managing personal finances independently, find the rent ledger to be a practical tool. As they juggle entry-level salaries, student loans, and other financial commitments, staying organized with rental payments is crucial for stability and planning. A rent ledger assists them in maintaining punctuality with rent, which is essential for building a good rental history—something that can influence future housing opportunities.

For families, the situation is slightly different but no less important. With often larger and more complex financial situations, having a clear overview of rental payments helps families budget effectively and plan for future expenses. Families can ally the use of a rent ledger with resources on tenant rights, such as those here, to ensure a comprehensive approach to managing their housing responsibilities.

Furthermore, a rent ledger can also aid in detecting discrepancies early on. If there is ever a mismatch between what has been paid and what is recorded, both tenants and landlords have a reference point to address and resolve these issues quickly and amicably.

Overall, adopting the practice of maintaining a rent ledger is essential for fostering an organized and stress-free rental experience. Whether you’re a student, a young professional, or head of a family, the benefits of a well-kept rent ledger are manifold, ensuring peace of mind and financial transparency in your housing arrangements.

Deciphering Your Rent Ledger: Key Components to Know

A rent ledger is a critical tool for tenants who want to manage their lease effectively. Understanding its essential components can help you maintain clarity over your financial responsibilities and prevent disputes. Let’s delve into the key sections you should know about.

Payment History

Your payment history is a chronological record of all the payments made towards rent. Each entry shows the date of payment, the amount, and the payment method. This section is crucial for ensuring that all your payments are accurately documented. Discrepancies here may lead to financial misunderstandings, so verify each entry against your own records regularly.

Due Dates

The due dates section outlines when your rent is expected each month. This part of the ledger helps you plan your finances and avoid late fees. Set reminders a few days before the due date to ensure you have sufficient funds or consider setting up automatic payments, if available, to streamline this process.

Fees and Penalties

Rent ledgers also detail any additional fees or penalties you might incur. Common fees include late payment fees, maintenance charges, or service fees. Understanding these entries is vital to avoid unexpected financial burdens. Consistently checking this section can help you spot any recurring fees and address them promptly.

Security Deposit

The security deposit section records the amount held as a deposit and any deductions made during or at the end of your lease. This component is particularly useful if you’re preparing to move out and need to ensure you meet the requirements for a full refund. Knowing your deposit status can also aid in budgeting for moving expenses.

Having a firm grip on these components empowers you as a tenant. It lets you address any issues proactively and seek clarity where discrepancies occur. This vigilance can also serve as a starting point for resolving larger financial concerns related to your lease, as discussed in related articles such as lease financial obligations.

Regularly reviewing and understanding your rent ledger isn’t just about tracking payments. It’s an essential part of ensuring your living arrangement remains harmonious and financially sound. Make it a habit, and you’ll find that managing your rent becomes a much more straightforward process.

Final words

Grasping the concept of an apartment rent ledger equips you with the tools needed for effective financial management in your renting journey. With clarity about details such as payment history, due dates, and fees, you gain confidence in communicating with landlords and managing your budget effectively. Remember, this ledger is not just a history of payments but a strategic asset in fostering a transparent relationship with your landlord. By understanding its implications, you pave the way for a smoother rental experience, free from financial surprises and confusion. Armed with this knowledge, you can approach your rental situation with clarity and confidence.