Navigating the world of apartment rental insurance can seem daunting, especially for renters who value safety and security. In an ever-changing environment, understanding the essentials of this insurance can provide peace of mind and protect your personal belongings from unforeseen mishaps. Whether it’s a leaky pipe, fire damage, or theft, renter’s insurance is designed to cover a range of incidents—enabling you to feel secure in your living space. However, misconceptions about coverage often create confusion and hesitation around obtaining this important protection. In this guide, we’ll tackle common questions and concerns surrounding apartment rental insurance. By demystifying this vital aspect of renting, you can make informed decisions that safeguard your home, ensuring both safety and a stress-free living experience.

Understanding Apartment Rental Insurance Basics

Whether you’re renting your first apartment or looking to switch residences, understanding apartment rental insurance basics is crucial for protecting yourself and your belongings. Rental insurance often seems like an extra expense, but its coverage is comprehensive and invaluable when the unexpected occurs.

What Apartment Rental Insurance Covers

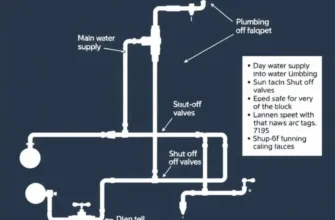

Rental insurance policies generally consist of three key coverage types: personal belongings, liability protection, and additional living expenses. Each plays a significant role in safeguarding different aspects of your rental experience.

Personal Belongings: This coverage helps replace personal items such as clothes, electronics, and furniture if they’re damaged or stolen. Covered events usually include theft, fire, or water damage (excluding floods from external sources). To ensure adequate protection, creating an inventory of your belongings with photos or receipts is a smart approach.

Liability Protection: This is a vital component of rental insurance as it covers legal expenses and damages if someone is injured in your apartment. Accidents can happen, and liability protection ensures that you’re not solely responsible for costly medical or legal fees if they arise from incidents like slips or falls.

Additional Living Expenses: If a covered peril makes your apartment uninhabitable, this coverage assists with the costs of temporary accommodation, meals, and other living expenses while your home is being repaired. This support is invaluable in allowing you to maintain your standard of living during disruptive situations.

Understanding Common Exclusions

While rental insurance is comprehensive, it’s important to be aware of common exclusions that might apply. Policies typically do not cover flood damage from external sources, earthquakes, or certain types of high-value items unless additional coverage is purchased. Additionally, damages from routine wear and tear are also omitted.

To bridge these gaps, consider options for supplemental insurance, like flood or earthquake policies, especially if residing in high-risk areas. For high-value belongings, such as jewelry or expensive electronics, separate riders can be purchased to ensure full coverage.

Prioritizing Your Safety and Security Needs

Rental insurance isn’t a one-size-fits-all solution. Evaluating your specific needs before choosing a policy can help you make well-informed decisions. Determine the type and extent of protection you need based on factors such as local climate, building history, and the value of your belongings.

Consider apartment radon safety methods to assess environmental hazards that might require additional coverage or protective measures. Understanding your priorities will not only ensure better protection but also give you peace of mind.

By having a clear understanding of what rental insurance covers, excluding the mentioned limitations, renters can make proactive decisions to enhance their safety and security. This foundational knowledge sets the stage for exploring more nuanced aspects of rental insurance in subsequent chapters.

Key FAQs: Your Concerns Addressed

When navigating the world of apartment rental insurance, renters often have a plethora of questions. Understanding these concerns is crucial to making informed decisions that prioritize safety, security, and peace of mind. This chapter addresses some of the most frequently asked questions to help renters confidently navigate their insurance options.

Do I really need rental insurance?

Many renters believe apartment rental insurance is optional. However, it’s often highly recommended, as it provides protection against unforeseen circumstances such as theft, fire, or damage to personal property. In fact, some landlords require tenants to have insurance as part of the lease agreement. Having insurance can also cover you in case someone gets injured in your apartment, offering liability protection.

What does rental insurance cover?

Standard rental insurance typically covers personal property, liability, and additional living expenses. Personal property coverage reimburses you for belongings damaged or stolen due to covered perils. Liability coverage protects you if someone is injured in your apartment. Additionally, if your unit becomes uninhabitable due to a covered event, insurance can cover the additional costs of temporary living arrangements.

What’s the average cost of rental insurance?

The cost of rental insurance varies based on factors like location, coverage amounts, and personal risk factors. On average, renters might spend between $15 to $30 per month. While this represents an additional expense, the benefits often outweigh the costs, especially considering the protection offered. To keep premiums low, consider opting for higher deductibles.

How do I file a claim?

Filing a claim can seem daunting, but it’s a straightforward process. First, document the damage or theft by taking photographs and making a list of affected items. Next, contact your insurance provider to report the claim. Your provider will guide you through the process, which may include submitting a police report for theft cases or repair estimates for damages. Keep a record of all communications and submissions to streamline the process.

Are there any common exclusions I should be aware of?

Rental insurance policies may not cover everything. Flood and earthquake damage are common exclusions. If you live in an area prone to such events, consider purchasing additional coverage. Also, high-value items like jewelry or electronics may have limited coverage, necessitating additional endorsements for complete protection.

To explore more about maintaining a safe apartment, including safe apartment laundry habits, check out this insightful guide.

Addressing these FAQs equips renters with the knowledge to make informed decisions about insurance, resulting in enhanced security and reduced stress.

Final words

Apartment rental insurance is more than just a policy; it’s a shield that protects your belongings and creates a sense of security in your living environment. Addressing common questions provides clarity and empowers renters to take the necessary steps to secure their homes. Understanding what coverage includes and how to navigate potential claims can relieve stress and enhance your rental experience. By prioritizing safety and taking proactive measures through insurance, you invest not only in your possessions but also in your peace of mind as a renter.